Australia has huge renewable energy resources for producing green hydrogen © amophoto/AdobeStock

HySupply: German-Australian Feasibility Study of Hydrogen

The HySupply project was a result of the previous cooperation project with acatech - Academy of Science and Engineering "Pathways to the Future of Energy", in which the last fact-finding mission led to Australia. Supported by the German Federal Ministry of Education and Research (BMBF), a German delegation met with leading research institutions and companies in the field of energy and hydrogen. The most important finding of the trip: Australia is a suitable partner for a long-term hydrogen partnership with Germany.

The project

The HySupply project was coordinated jointly by the BDI and acatech and funded by the BMBF. The Australian consortium was led by the University of New South Wales (UNSW) and funded by the Department of Foreign Affairs and Trade (DFAT). Together, the two sides brought together a unique network of companies and scientific experts to investigate the entire value chain of renewable hydrogen from Australia.

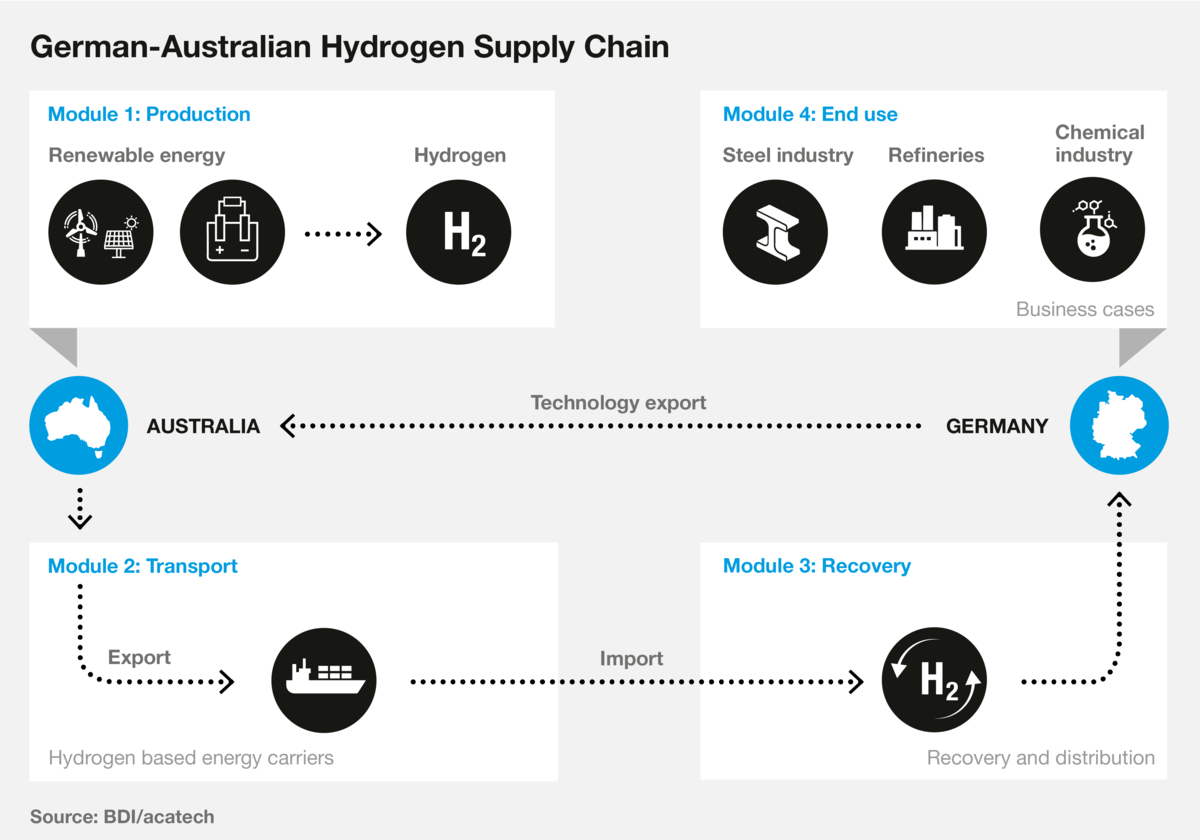

The feasibility study consists of a range of milestones that were developed over the course of two years. The results show that the German-Australian hydrogen bridge can already be realized before 2030. To enable the import of renewable hydrogen from Australia in a timely manner, the right framework conditions must be created now. This would not only lay the foundation for the supply chain with Australia but also for other potential export countries.

Illustration of a potential German-Australian hydrogen supply chain © BDI/acatech

Why do we need hydrogen from Australia?

That Germany can be energy self-sufficient is an illusion. Especially against the backdrop of the Russian war of aggression, it becomes clear how much Germany is dependent on imports of fossil fuels. Similarly, Germany will depend on the imports of hydrogen and hydrogen-based energy carriers, so-called power-to-X products (PtX). The National Hydrogen Strategy published in 2020 aims to build five GW of electrolysis capacity in this country by 2030. Even with the target of ten GW by 2030 defined in the coalition agreement, demand exceeds domestic production by far: while these ten GW could produce around one million metric tons of renewable hydrogen, the German government assumes hydrogen demand of up to three million metric tons. At the European level, the REPowerEU plan which has been presented in response to the Russia-Ukraine war also aims for a target of ten million tons of domestic production of renewable hydrogen plus ten million tons of imports by 2030.

Therefore, it is important more than ever to cooperate with strong and reliable countries in order to diversify hydrogen imports and thereby ensure security of supply. One of these countries is Australia.

What are the options to import renewable hydrogen from Australia?

As a first milestone, the working paper of the German project group "A Meta-Analysis towards the German-Australian Supply Chain for Renewable Hydrogen" has investigated four transport options for the import of renewable hydrogen from Australia: Liquid Hydrogen (LH2), Liquid Organic Hydrogen Carriers (LOHC), Ammonia (NH3), and Methanol (MeOH). The results show that the transport options have different advantages and disadvantages and, most importantly, different levels of technological maturity. Nevertheless, there are also challenges that all options have in common such as the fluctuating power generation from renewable energy sources or the lack of relevant infrastructure such as export and import terminals. In addition, there are still regulatory uncertainties for all options, especially with regard to the legally secure definition of "renewable" hydrogen and PtX products.

What role does the distance to Australia play?

The distance between Germany and Australia is considerable. For example, there are no direct flights and the shipping route between the two countries is approximately 21,000 km. Nevertheless, the German-Australian trade volume in 2020 was more than eleven billion euros. Most of these products come from the automotive, pharmaceutical and raw materials sectors, especially hard coal. This shows that distance is already no obstacle to the trade of goods from Australia. On the contrary. The EU wants to strengthen trade relations through the planned free trade agreement with Australia.

With regard to costs of transporting hydrogen, the working paper of the Australian project group "The Case for an Australian Hydrogen Export Market to Germany: State of Play Version 1.0" shows that shipping accounts for only a fraction of the total costs, especially for the technically mature transport options. For example, at hydrogen production costs of four Euro/kg, transport in the form of ammonia accounts for only a seven percent share, or between seven and nine cents per kilo of ammonia. In the case of methanol, the share is around five percent at four to six cents per kilo of methanol.

How climate-neutral is the hydrogen imported from Australia?

It is a fair question to ask how climate-neutral the hydrogen still is when it arrives at the port in Germany or the EU. After all, worldwide shipping is responsible for around 2.6 percent of global CO2 emissions. Nevertheless, preliminary results show that the direct CO2 emissions of transport from Australia to Europe, including the return journey, are low to moderate, even with the use of heavy fuel oil. The size of the ship plays a decisive role here, which is why the specific CO2 emissions of large tankers, such as those for ammonia and methanol, are still well below existing limits, such as those of the taxonomy or the TÜV SÜD standard for green hydrogen.

In the end, it is decisive that the climate-neutral property of the hydrogen supplied is credibly traceable. This requires a uniform international certification system based on the hydrogen's carbon footprint.

Are there regulatory barriers to importing renewable hydrogen from Australia?

This question has been investigated by the study commissioned by HySupply from the Institute for Climate Protection, Energy and Mobility (IKEM) on the regulatory framework for a German-Australian hydrogen bridge. The results show: importing hydrogen from Australia to Germany via the four transport options investigated (LH2, LOHC, NH3, MeOH) is in principle legally feasible. However, in some cases there are high legal requirements that make the implementation of the respective pathways considerably more difficult. For example, one of the major obstacles is the construction of import terminals, including the safety distances to be maintained from adjacent infrastructure, which means that not every port in Europe is suitable for importing all of the four hydrogen carriers. In addition, there are land-based route restrictions, for example, for the transport of ammonia. In general, it is clear that accelerated planning and approval procedures are needed for a timely implementation of the supply chain, e.g. in the area of shortening the time for public participation or making compensation measures more flexible in terms of time.

What needs to happen now to realize the German-Australian hydrogen bridge?

The results of HySupply show that the German-Australian hydrogen bridge is technically, economically and regulatory feasible. In order to realize the supply chain with Australia before 2030, the right framework conditions must be created now. HySupply-Germany's Demand-Side Action Plan outlines the measures to be taken over the next 24 months to achieve this. These include securing offtake in Germany and introducing a legally secure definition for renewable hydrogen and its derivatives. Equally important is the prompt creation of an import and distribution infrastructure in Germany and the EU. At the same time, hydrogen projects in Australia must be brought to the right scale to be suitable for export. Here, German manufacturers and suppliers can take a leading role in the required technologies. Last but not least, existing and emerging hydrogen collaborations with Australia need to be coordinated and aligned to maximize their impact.

Members of HySupply

The added value of the project results from the broad expertise of the experts involved. From industry, a number of companies and associations have been involved since the start of the project, including Air Liquide S.A., BASF SE, Port of Rotterdam Authority, Deutsche Lufthansa AG, Linde GmbH, Wirtschaftsverband Fuels & Energie (en2x), RWE Supply & Trading GmbH, Siemens Energy AG and thyssenkrupp Steel Europe AG. Other companies such as Robert Bosch GmbH, SAP SE, Schaeffler AG and thyssenkrupp nucera Australia also provided their expertise to the German group.

In addition, leading experts from the research community contributed their knowledge, including Frank-Detlef Drake (E.ON Energy Research Center at RWTH Aachen University), Veronika Grimm (FAU Erlangen-Nuremberg), Christian Growitsch (Fraunhofer IMW), Dominik Härle (Fraunhofer-Gesellschaft), Christopher Hebling (Fraunhofer ISE), Andreas Löschel (Ruhr-Universität Bochum), Karen Pittel (ifo Institute), Mario Ragwitz (Fraunhofer IEG), Christoph M. Schmidt (RWI), and Maike Schmidt (ZSW), Michael Sterner (OTH/FENES) and Peter Wasserscheid (FAU Erlangen-Nuremberg).

The Australian project group was led by the University of New South Wales (UNSW), with Baringa Partners and Deloitte as key partners. Additional support for the consortium came from other industry partners such as MAN Energy, GPA Engineering and Scimita Ventures.

HySupply Delegation on top/infront fuel cell powered truck from FFI. © Cath Leo